The Evaluator Summer 2023

California Appeals Court Affirms Assessor’s Increase in Value Via Raise Letter Issued in Response to Owner’s Reduction Request

The owners of a shopping center appealed from a judgment entered in a property tax refund action after the trial court upheld the decision of the Los Angeles County Assessment Appeals Board (Board) concerning the center’s 2011 valuation. Click here to learn more.

_____________

Ohio Budget Bill Establishes New Uniform Rules, Formula for Valuing Affordable Housing Projects

Ohio budget legislation (Budget Bill) signed in early July deleted a new statutory provision that had just become effective on April 7, 2023. Click here to learn more.

_____________

Missouri Tax Commission Rejects Appraiser’s Reliance on Vacant and Soon-To-Be Vacant Retail Properties to Value Occupied Big Box Store.

The Missouri Tax Commission (Commission) sustained the assessor’s value of a big-box department store after rejecting the property owner’s appraisal evidence. Click here to learn more.

_____________

Texas Governor Signs Property and Franchise Tax Relief Bills

Governor Greg Abbot has signed Senate Bill 2, the property tax relief bill and Senate Bill 3, the franchise tax relief bill. These tax relief measures will go before Texas voters for approval at the November elections. Click here to learn more.

_____________

Colorado Supreme Court Dismisses Taxpayers’ Complaints Seeking Revaluation of Their Properties for Tax Year 2020 Because of the Covid-19 Pandemic and Subsequent Government Restrictions

The Colorado Supreme Court recently issued decisions in four of the 11 coordinated cases brought by property owners seeking revaluation of their properties in 2020, an off cycle assessment year, as a result of the COVID-19 pandemic and subsequent government restrictions. Click here to learn more.

OTHER VALUATION HEADLINES FROM ACROSS THE COUNTRY (CLICK HERE TO READ MORE)

The Ohio Supreme Court Reverses the Strict Construction Rule of Statutory Tax Exemptions

__________________________

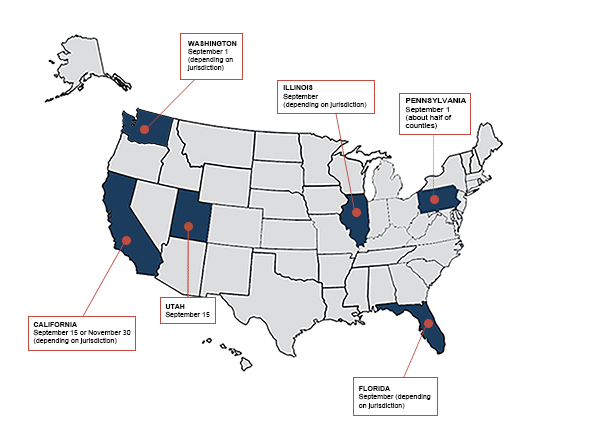

Deadlines Looming Across the U.S.

Taxpayers seeking to contest real property tax values established by assessing jurisdictions across the country often have a short window of opportunity to contest their new valuation. This time frame varies by state and by local jurisdiction, and in many cases begins to run upon the mailing of a new value notice. Below is a map of states/jurisdictions with upcoming appeal deadlines:

click on map to enlarge